This article originally appeared on Bloomberg on February 9, 2016 and was written by Brian Eckhouse and Joe Ryan .

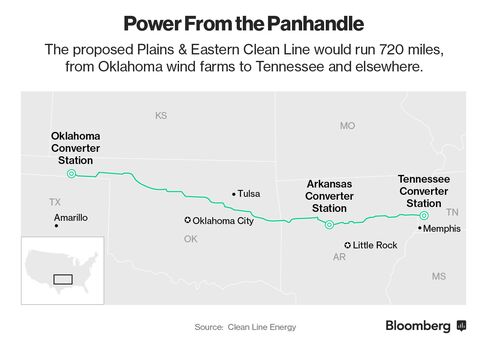

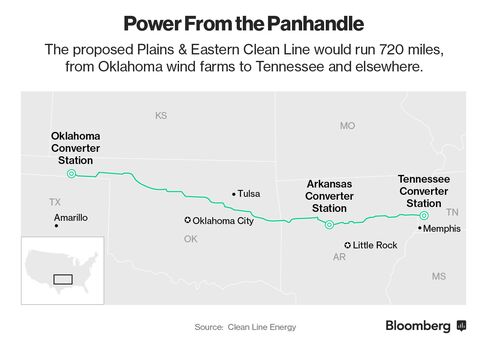

That’s why Clean Line Energy Partners LLC plans to spend $9 billion on power transmission across the Great Plains, Midwest and the Southwest, including a 720-mile (1,158-kilometer) proposal awaiting approval from the U.S. Energy Department. It would be one of the longest high-voltage direct current lines built in a generation, and is among at least 11 proposed projects that may open up vast expanses for wind and solar farms with more than 26 gigawatts of capacity.

Renewable energy advocates say long-distance transmission will tap the wind and solar potential of the Great Plains and Sun Belt the way pipelines opened up once-inaccessible oil fields in Alaska and Siberia. These projects are seen as essential to helping states comply with President Barack Obama’s Clean Power Plan, which requires them to reduce emissions from power plants, and will help the U.S. meet its goals of getting 20 percent of its electricity from renewable sources by 2030.

“It doesn’t take a genius to say that the challenge is on the transmission side,” said Michael Skelly, president of Houston-based Clean Line. “That would enable a lot of renewable energy projects.”

It’s not easy to build transmission lines across vast regions of the country. The permitting process varies by state and can take a decade. Opposition can be fierce from landowners who don’t want high-voltage lines lines cutting through their farms or backyards. And officials can be leery of supporting projects that ships power through their jurisdiction only to deliver it to another state.

Clean Line, which is proposing five separate lines, asked Iowa regulators to suspend review of its 500-mile Rock Island line last year as the company plots its course through the approval process amid opposition from landowners. In July, Missouri’s Public Service Commission voted to block the company’s 780-mile Grain Belt Express line, saying the developer hadn’t proven the need for the $2 billion project.

“Transmission is the industry’s biggest long-term opportunity,” said Rob Gramlich, a senior vice president at the American Wind Energy Association, a Washington-based trade group. “But it’s also its biggest challenge.”

Clean Line

Clean Line was founded in 2009 by Skelly, a veteran of Horizon Wind Energy, which Goldman Sachs Group Inc. sold to EDP-Energias de Portugal SA in 2007. Clean Line is backed by ZBI Ventures, the investment firm controlled by the Ziff family.

The project awaiting final approval from the Energy Department, the Plains & Eastern Clean Line, will cost as much as $2.5 billion. It will be able to carry as much as 4,000 megawatts of power, linking wind farms in Oklahoma, Kansas and Texas with utilities in Tennessee, Arkansas and elsewhere in the Southeast.

The company plans to break ground next year and expects to complete it by 2020. East Texas Electric Cooperative agreed in May to buy 50 megawatts of capacity on the line.

Other developers are planning long-haul lines to move clean power across the country.

Anbaric Transmission is developing two projects in New England with National Grid Plc. A 250-mileline from wind farms in Maine to Boston is awaiting state approval. A 60-mile link from upstate New York wind farms to Vermont may be complete by 2020 and the Chicago developer Invenergy LLC and the Canadian utility Hydro-Quebec have both agreed to use it. Anbaric hasn’t determined costs for either project.

Vermont, New York

Transmission Developers Inc., backed by Blackstone Group LP, has proposed two lines to ship energy from Canadian hydro plants to Vermont and New York City, with a total estimated cost of $3.4 billion. And SunZia Transmission LLC is awaiting state approval for a pair of 515-mile lines that will cost $1.2 billion and will carry power from solar and wind farms in New Mexico to customers in Arizona and California.

Amy Grace, Bloomberg New Energy Finance’s lead wind analyst, said the question remains whether it would be cheaper to build wind farms on the outskirts of cities, where land prices are higher but transmission is easier.

“Will the cost of building wind in the central regions be so much cheaper than building wind closer to demand centers?” Grace said.

Filling a Gap

“Up until the last 10 years, no one had given much consideration to long-haul transmission,” says Bill Miller, president and CEO of TransWest Express LLC, which is planning a 730-mile line from Wyoming to Las Vegas. The Denver-based company plans to start construction in 2017 on the $3 billion project, which needs federal approval.

Most recent transmission projects are shorter lines designed to increase the reliability of grids, rather than send power long distances, said James Hoecker, counsel to Wires, the transmission industry’s Washington-based trade group. Utilities typically don’t have much motivation to build long lines that extend beyond their service areas.

Clean Line and the other developers are seeking to fill that gap. Because local power companies are usually state-based and state-regulated, Skelly said they don’t focus on how to serve entire regions, or how to run wires from wind-whipped plains to energy-hungry cities.

“Utilities don’t wake up thinking, ‘how do I get power to Atlanta?’” he said.